Volatility Returns to Equity Markets

No doubt many of you have been following the news these last several weeks. After an unusually long period of stability, volatility has returned to the U.S. equity markets. October is shaping up to be one of the worst months for investors in several years. Investors have a lot to be worried about including trade tariffs, mid-term elections, and a more hawkish Fed. We would like to share our perspective on the return of volatility to the stock market.

Ten years – that is how long this economy has been expanding since the Financial Crisis. We’ve seen “Green Shoots,” “Taper Tantrums,” and most recently, the double whammy of rising interest rates and global trade conflicts. Despite all these concerns the 3rd quarter GDP was reported this morning at a very robust 3.5%, ahead of consensus.

If viewed in isolation, the events of the last few weeks are certainly concerning. However; when viewed in the context of economic cycles, the return of volatility should be welcomed by investors. This may seem contrary to conventional wisdom which might view volatility as a forewarning of worse things to come. Our view is the return of volatility implies this economy is strong enough to withstand normalized interest rates after a decade of exceptional policy accommodation by the Federal Reserve Bank. Said another way, the Fed is comfortable managing short term interest rates in a way that encourages investment and growth but also with an eye toward managing future inflation expectations.

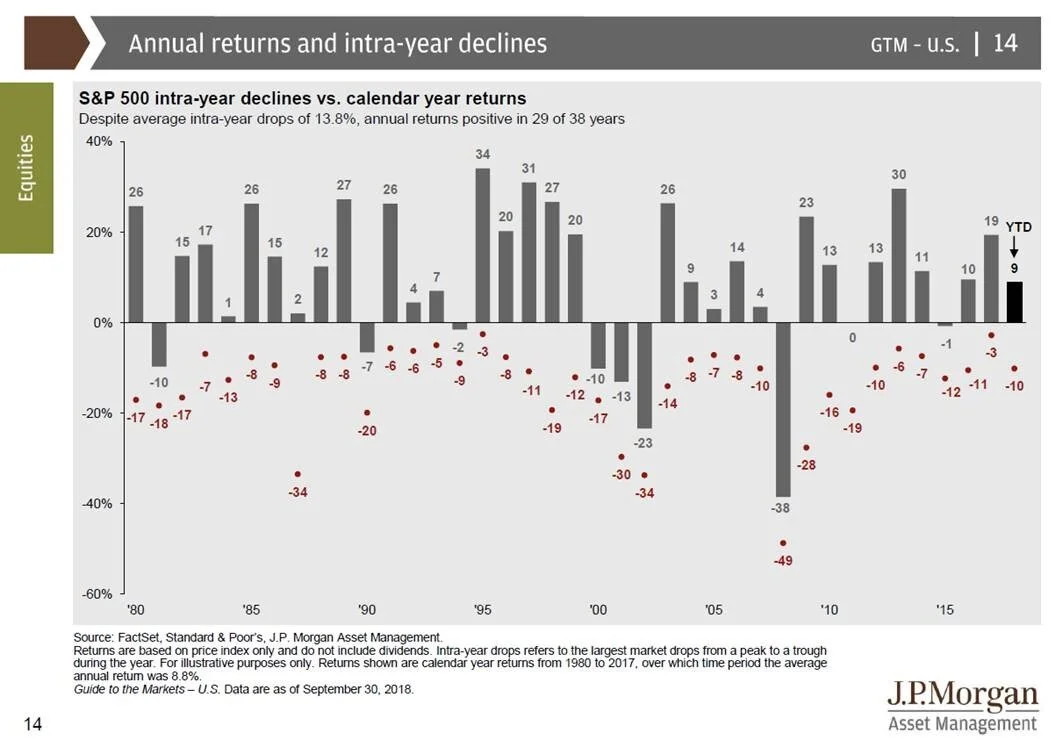

So what insight can we gain from the return of volatility? The chart below shows annual returns for the S&P500 (the gray bar) and the maximum decline experienced during each particular year (the red dot).

One quick and important observation – equity markets are volatile even in many of the “good” years. Despite average declines during any particular year of 13.8%, the S&P500 posted annual positive returns 29 out of 38 years shown in the graph. Since 1980, the S&P500 has posted positive annual returns 76% of the time. But you might ask “What about the volatility? Does it predict negative returns? Unfortunately, not much. Take 1987 for example. On October 19, 1987, commonly known as Black Monday, the equity markets declined 22% for the day. The low point for the year was -34%. Those who sold their positions probably wish they could have a “re-do” since the market rebounded and eked out a 2% gain for the year. Those who “got out” turned a temporary loss into a permanent one.

Is 1987 an isolated case? Not really. Two other periods illustrate similar outcomes. Both 2003 and 2009 experienced significant declines during the year but finished the year well above the low point for the year. Some might argue these periods occurred after enormous corrections. Fair enough. So, let’s look at a period of time where interest rates are rising in a healthy economy. The most recent example would be 2003-2007 which followed the Tech Bubble crash of 2000. What we see is that even in the face of rising rates, draw-downs offer little insight on which direction markets moved next. In every year from 2003 to 2007, the market was positive even as interest rates were increasing.

We would offer one more point. There is no historical precedent where the age of a bull market predicts an equity market correction. Bull markets most commonly end because changes in monetary policy undermine the value of equity investments. Recent studies from Goldman Sachs support the fact there has never been a recession when monetary policy and fiscal policy are aligned as they are currently. These current policies are not permanent however, and they will change over time.

So, what is our recommendation for clients during this time of volatility? If your portfolio is properly allocated (by proper, we mean consistent with your appetite for risk) and your investment horizon (the length of time before you need to access the money) is long-term, you should take comfort knowing that we have built your portfolio so that it can side step the full magnitude of a major decline in the equity markets. Please note that we are not saying you will entirely avoid a correction, but it your portfolio should not move in lock-step either.

We will be keeping a close eye on Federal Reserve Bank policy over the next 12-24 months to see how any changes might affect equity valuations. During this period, investors should not be surprised by volatility like that of the last several weeks. We think now is a great time for our clients to make sure their investment plan is appropriate for their long-term financial goals. Please call us if we can help you with that exercise.

We hope all of you have a good weekend and, as always, we thank you for choosing us as your financial advisor.

Best regards,

Patton Albertson & Miller